Share this

by Laura Richards on December 5, 2023

It’s the most wonderful time of the year to check your CAM clause.

Throughout the winter months, shoppers notice holiday magic whenever they leave the house.

What they don’t see is the retail tenants and landlords at the negotiating table. Each passionately defending why they shouldn't pay for that giant light-up reindeer.

So, are decorations part of common area maintenance? Or, are they the tenant’s responsibility?

If you don’t know the answer, you may be entering December like Clark Griswold opening his Jelly of the Month Club certificate – very, very unhappy.

Common area maintenance charges (CAM) include the shared amenities, utilities and services of tenants in commercial properties. For office buildings and shopping centers, the purchase and setup of holiday decorations is often included in CAM expenses.

Triple net, net net, net and gross leases could all be on the table when leasing your new space. Depending on the type of lease in place, retailers can pay for everything that comes up or just toss some money in the pot for property taxes.

Which is why you may want to do the work to understand which type of lease would be best for that place, time and circumstances.

What type of lease is right for you?

Click here to see what your options are.

Two Important Questions for Your Landlord

Cindy Headman, Director of Lease Administration for Burlington Stores, suggests asking two questions when negotiating CAM charges.

- What is the intent of the landlord?

- What is reasonable for the landlord to ask of us?

For example, we all value a tidy restroom for our employees and customers. Therefore, it’s reasonable to include custodial costs in CAM.

If your space is a rarely visited warehouse, it may not be reasonable to spend money on a 30-foot Christmas tree.

The intent question is a bit more nuanced, especially when starting a completely new lease. Does the intent behind certain clauses match your goals and values? Will they have your back when push comes to shove (hello, COVID shutdowns)?

If the intent seems to be Scrooge adjacent, you jump to question two. Is it a reasonable ask?

Where does the number come from?

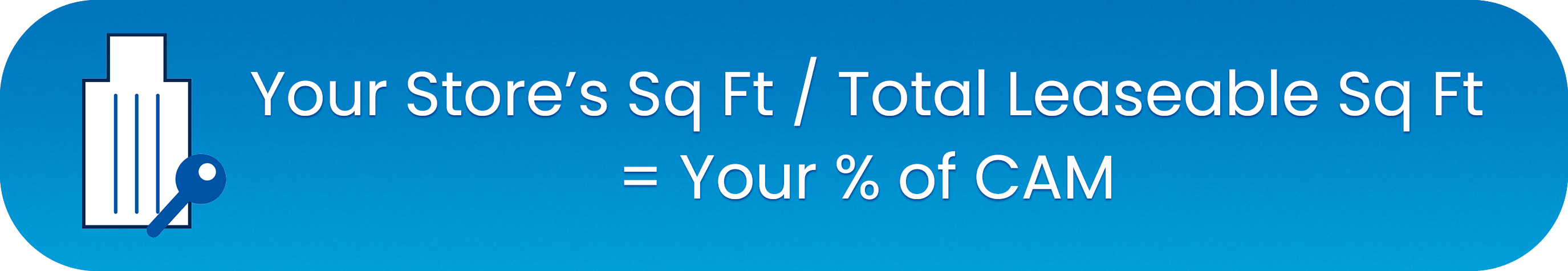

Most landlords determine charges by calculating a retailer’s pro-rata share. First, they analyze CAM totals from previous years to determine the total amount needed from all tenants for the next year’s CAM.

Then, they do a simple equation to determine the pro-rata share of that total. The total square footage of the retailer's property (your store) is divided by the total rentable square footage in the property.

You'd pay your percentage share monthly and it will cover all controllable, operating expenses.

Uncontrollable expenses are a bit more of a mystery.

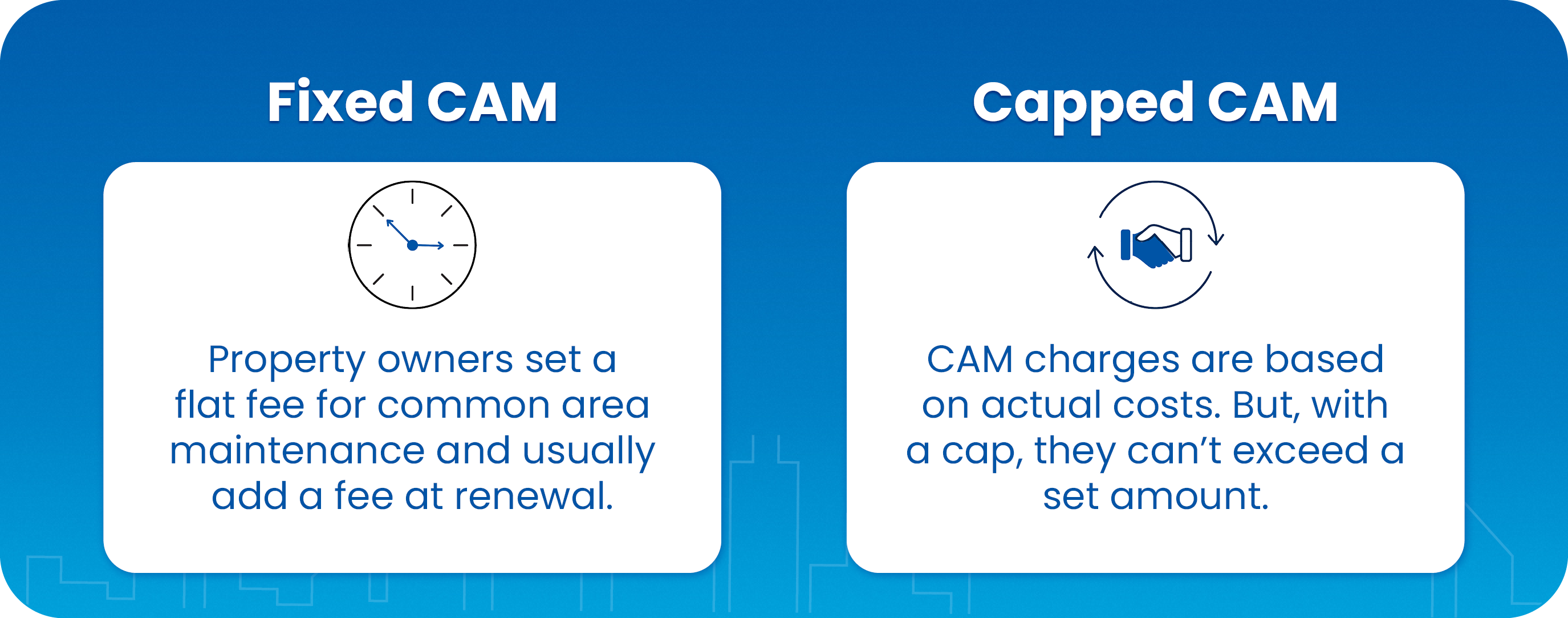

Fixed CAM

Fixed CAM is a great way to remove the mystery. Fixed CAM charges are exactly what they sound like - the property owner will set one flat fee for common area maintenance.

Over time, likely with renewals, that cost will rise because of inflation. But for the life of your lease, the charge amount will remain the same.

This simplified structure can eliminate unexpected charges. The repeated flat rate can protect you in an emergency. And prevent unnecessary charges for the holiday décor sprinkled throughout the property.

Capped CAM

If you’re unable to lock down fixed CAM costs, a backup plan is capped CAM charges. The owner would base the CAM charges on actual costs. However, with a cap, they can’t exceed a set dollar amount.

Once again, tenants have protection from unpleasant surprises.

Capping the charges will come up during lease negotiations. If a capped fee is something that you want, you may have to do a little quid pro.

So, this holiday season, while Santa is making his list and checking twice, you should check your CAM clauses. Merry Christmas to all and to all a good 13th period.

Share this

- Lease Accounting Software (90)

- ASC 842 (83)

- Accounting Teams (53)

- Lease Administration Software (27)

- Retail Tenants (16)

- Commercial Real Estate (14)

- Lease Management (13)

- Real Estate Teams (10)

- ESG (8)

- Market Data and Analytics (8)

- Success Stories (8)

- News and Media Coverage (5)

- Transaction Management Software (2)

- frs 102 (2)

- Customer Success (1)

- Healthcare real estate (1)

- Office Tenants (1)

- December 2025 (1)

- September 2025 (1)

- July 2025 (2)

- June 2025 (4)

- May 2025 (2)

- April 2025 (2)

- March 2025 (6)

- February 2025 (3)

- January 2025 (4)

- December 2024 (1)

- October 2024 (4)

- September 2024 (2)

- August 2024 (4)

- July 2024 (3)

- June 2024 (3)

- May 2024 (4)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (3)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

Retail Tenants Increase Profit by Aligning CRE Operations & Objectives

3 Ways to Make CAM Charges Work for You