Lease Accounting Software Built for Audit Readiness and Scale

Enterprise accounting teams rely on CoStar Real Estate Manager to simplify compliance and eliminate manual effort. The lease accounting platform automates ASC 842 and IFRS 16 reporting, integrates with major ERP systems, and centralizes every lease in one secure, audit-ready environment. When accuracy and accountability matter, organizations turn to CoStar.

Why Lease Accountants Trust CoStar Real Estate Manager

Automated Workflows

Save hours on manual tasks with automated calculations, remeasurements, and adjustments that keep every record accurate.

Audit-Ready Reporting

Generate reports instantly with built-in audit details and version tracking that make reviews effortless.

Flexible Accounting Setup

Map journal entries, manage multiple schedules per lease, and tailor dashboards to your organization's structure.

Unified Lease Data

Access every real estate and equipment lease in one secure platform for consistent, real-time visibility.

Lease accounting can be incredibly complex, particularly with respect to ASC 842 compliance...CoStar is very customizable and packed with a lot of both critical and helpful functions. I appreciate the option to use as many or as little of these features as the business needs.

Verified G2 Reviewer

Warehousing Industry

We migrated to Costar in 2017, and it has been a great experience. The 842 Accounting and the 842 Reporting works very well. We originally were tracking overage accrual in a multi-sheet manually. Now we track our overages and perform the monthly accrual within Costar.

Nancy E.

Enterprise Organization

I like how easy it is to use and how quickly we are able to create a journal entry. It helps us keep a great look on our leases, as well as automate our monthly journal entries.

Kelsey S.

Senior Accountant

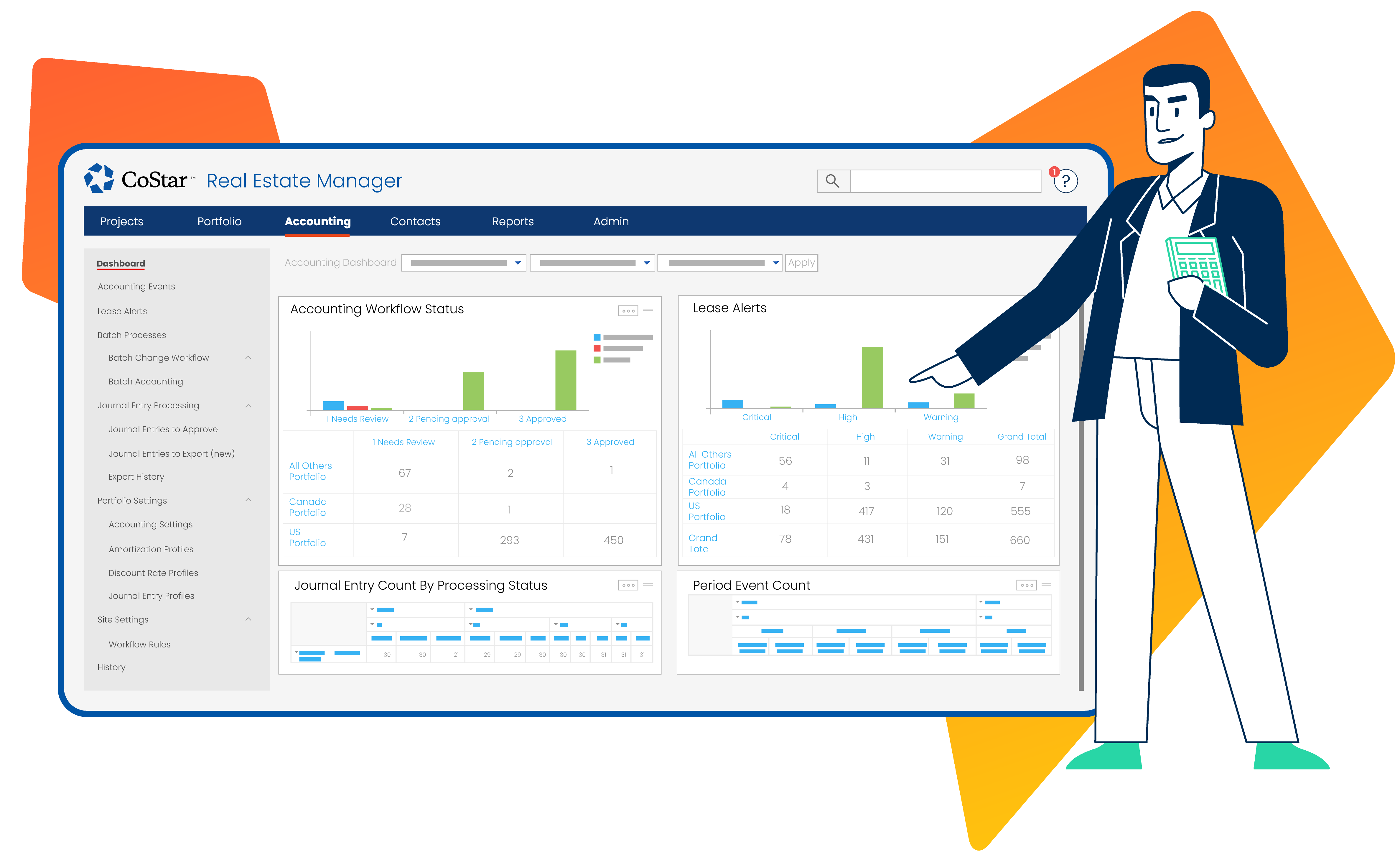

Enterprise-Grade Capabilities

CoStar Real Estate Manager equips enterprise accounting teams to manage thousands of leases with accuracy and control. The platform unifies compliance, automation, and reporting to help global organizations close faster and stay audit-ready.

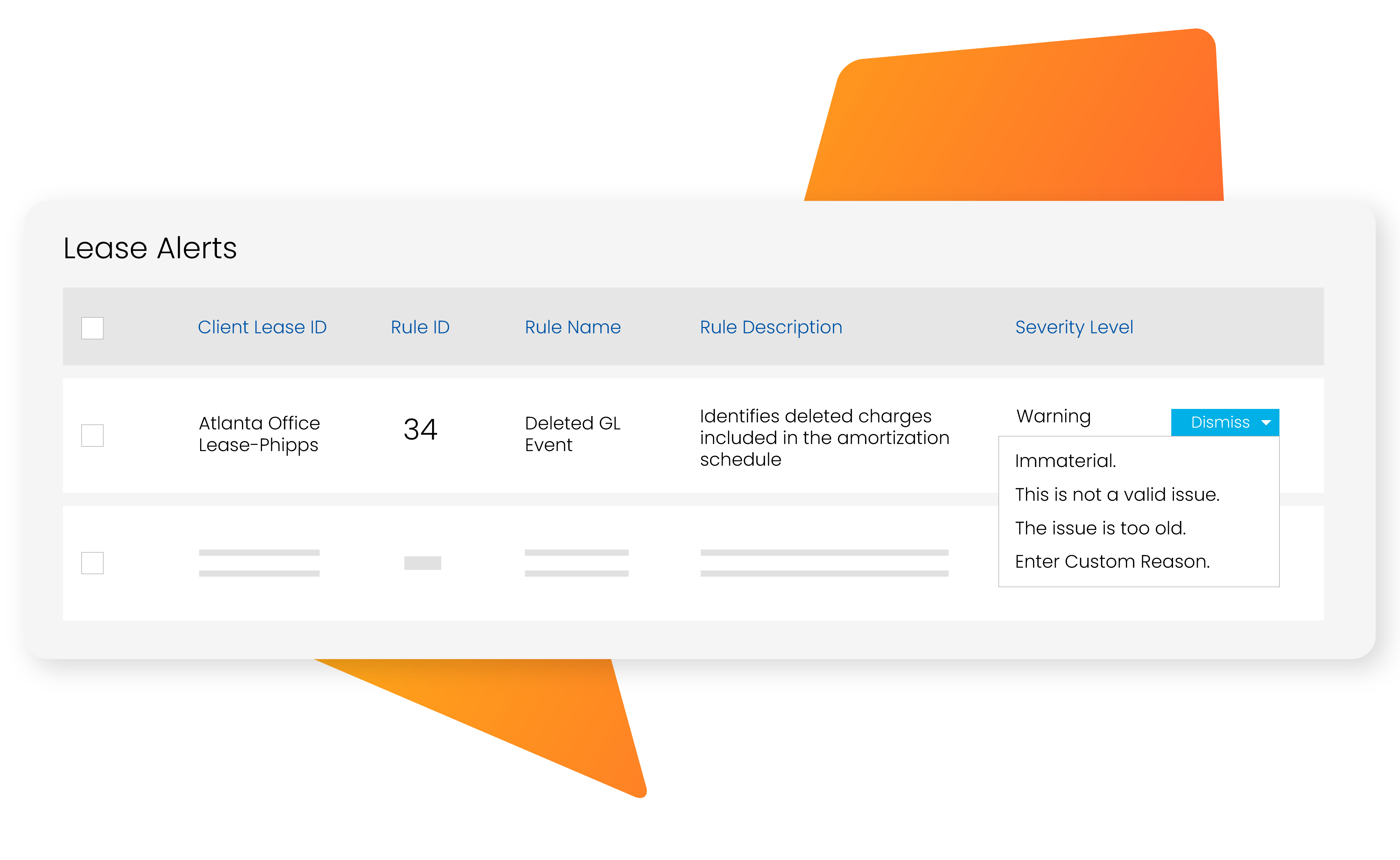

Advanced Controls and Audit Assurance

CoStar’s lease accounting software reinforces governance with detailed audit trails and SOC 1 Type II certified security. Every action and approval is tracked for full accountability, while continuous monitoring flags potential issues in real time to protect data integrity and simplify audit preparation.

Integrated Financial Workflows

With managed integrations to SAP, Oracle, Workday, and NetSuite, CoStar keeps journal entries, payments, and reports perfectly aligned. Continuous data flow eliminates reconciliation issues and delivers real-time visibility across financial systems.

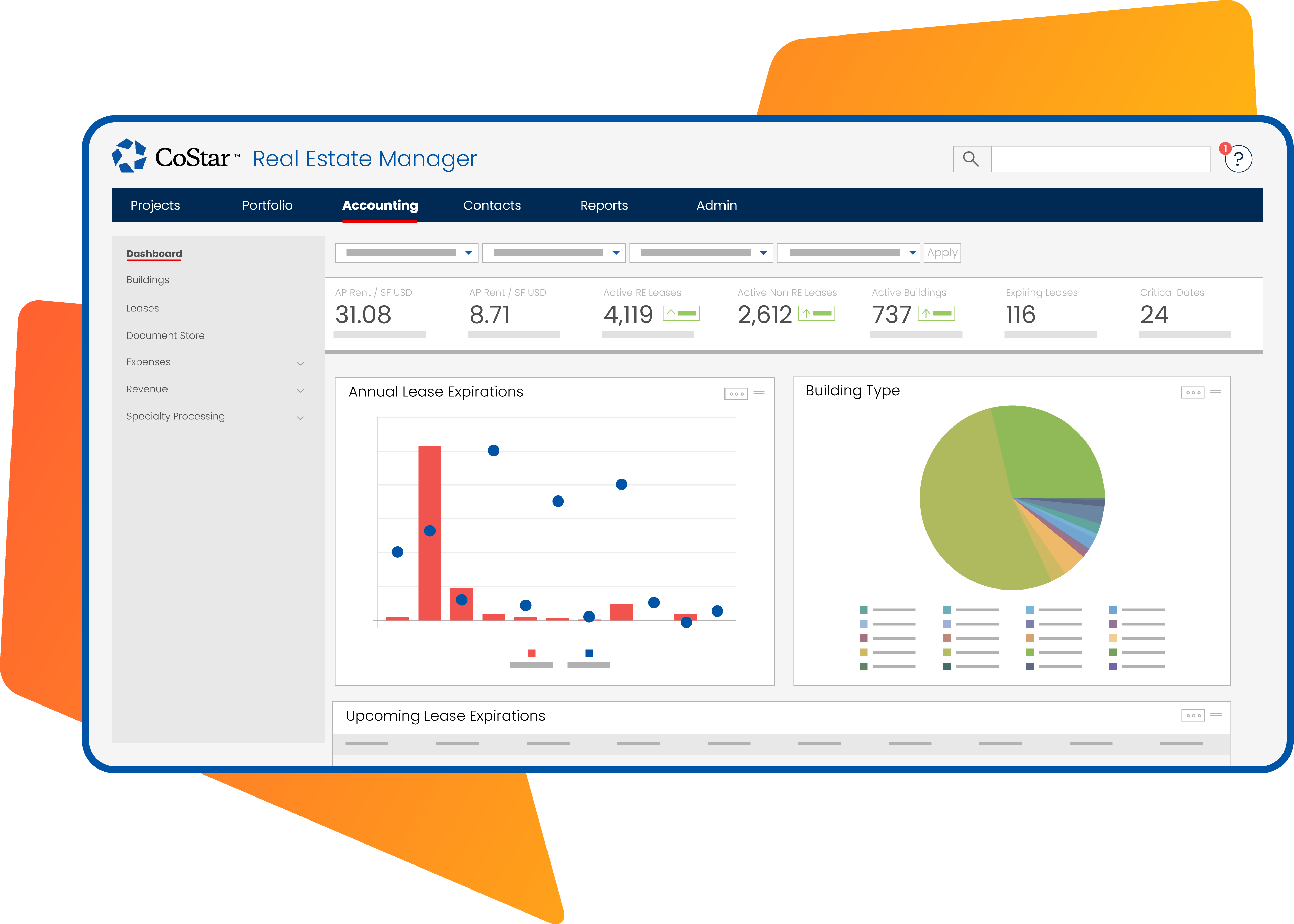

Scalable Data Management and Insights

CoStar Real Estate Manager centralizes thousands of real estate and equipment leases in a single, cloud-based platform. Configurable structures and dynamic dashboards provide clarity across entities, regions, and asset types, turning complex data into actionable insight.

CoStar Real Estate Manager Lease Accounting Software FAQs

CoStar Real Estate Manager automates lease classification, measurement, and reporting to ensure consistent compliance with ASC 842, IFRS 16, and FRS 102. The platform generates audit-ready journal entries and disclosures for both real estate and equipment leases, keeping you compliant without manual work.

Spreadsheets make it easy to lose version control, miss deadlines, or introduce costly manual errors. Cloud-based software like CoStar Real Estate Manager centralizes every lease in one secure system, automates calculations and alerts, and keeps all teams working from the same real-time data. The result is stronger compliance, faster closes, and fewer surprises during audits.

A SOC 1 Type 2 report verifies that a provider’s internal controls for financial reporting have been independently tested and validated. It gives your organization assurance that critical lease data is protected and compliant with industry standards.

Break free from the hassle of sending different versions of the same file back and forth. Cloud-based software lets you grant the right access to every department — from accounting to legal — so everyone is working off the same, up-to-date information. Set up role-based permissions and custom alerts for renewals, critical deadlines, or upcoming decisions and ensure no one misses a beat (or a payment).

And for audits? Invite auditors in with read-only permissions and let them find exactly what they need, all without interrupting your workflow. Say goodbye to more frenzied searches or last-minute reports.

Unlock Real-Time Reporting & Fewer Surprises

With everything in one place, you gain true visibility into your lease portfolio. Automated reporting and customizable dashboards mean you see the big picture — capital allocation, forecasting, budgeting — with the data to back up every decision. When an unexpected event happens, you’ll be ready to pivot with confidence.

Critical date tracking isn't wishful thinking anymore; it’s automatic. Missed escalations, lost renewal windows, or forgotten amendments become a headache of the past.

Superior Collaboration and Fewer Errors

Let’s face it: spreadsheets make it all too easy to overlook important updates or introduce manual errors. Cloud-based lease accounting software keeps everyone on the same page, literally. Whether your team’s in Atlanta, Austin, or Ashtabula, you’re aligned and you’ll catch discrepancies instantly rather than after they snowball.

So if you want always-on compliance, fewer surprises, and a single source of truth, cloud-based lease accounting software is the better, smarter choice.

The best value goes beyond price. Choose a lease accounting platform that scales with your portfolio, integrates with your ERP systems, and keeps pace with evolving accounting standards to deliver long-term compliance and efficiency.

CoStar Real Estate Manager gives finance teams real-time visibility into lease obligations and future costs. With automated reporting and scenario modeling, you can forecast expenses, plan budgets, and allocate capital with greater accuracy.

CoStar Real Estate Manager simplifies global lease management with multi-entity, multi-currency, and dual-GAAP capabilities. Configurable hierarchies make it easy to manage regional compliance while maintaining consolidated reporting and corporate oversight.

Yes. CoStar manages real estate and equipment leases in one platform, ensuring consistent accounting, reporting, and visibility across all assets and business units.

Lease Accounting Software Tech Specs

Accounting Standards

ASC 842

IFRS 16

ASC 840

Local GAAP

Statutory GAAP

Audit & Security

Accounting schedules

Audit detail & change logs

Group & user profiles

Lease modifications

SSAE 18 SOC 1&2 Type 1&2

Controls

Data validation

Lease accounting journal entries

Lease classification tests

Security profiles

Single sign on (SSO)

Data Loading

Bulk lease data

Discount rates

Foreign currency

3rd Party integrations

Required fields

Lease Management

Equipment leases

Real estate leases

Multi-schedules per lease

No duplicate lease entries

Residual value

Lease remeasurement

Month End

High-volume capacity

JE approval & export

Payment processing

Period close out

Reconciliations

Vendor, AP, GL integration

Policy Setting

Fiscal calendars

APR/APY

Compound frequency

Lease/non-lease components

Amortization & JE profiles

Lease discount rate

Functional currency

Reporting

Ad hoc on all data fields

Amortization by lease

Disclosure report

Roll forward report

Tax data