Share this

by Matt Waters, CPA on May 10, 2022

Adoption of ASC 842 was challenging enough. No company implemented new lease accounting software expecting to replace it just a couple of years later. But many are doing just that. What are the reasons why lease accounting software systems fail?

Many corporate buyers found out the hard way that under-developed systems lack important functionality in nine key areas. This forces accounting teams to spend countless hours creating manual workarounds in spreadsheets, leading to lost productivity, control issues and serious audit challenges.

Industry experts with leading accounting firms estimate the failure rate among new lease accounting compliance projects is more than 25 percent based on feedback from public companies and early adopters. Much of that failure is attributed to the selection of inadequate lease accounting software.

Many newly developed, low-cost solutions appeared to have everything companies needed during the product demonstrations. But only after companies were neck-deep in tedious manual processes to make reporting work did they realize that their new solutions didn’t live up to supplier promises.

Here are the nine most common reasons why lease accounting software systems fail.

1. No Audit Details in Reports

Lease-level details needed by auditors simply aren’t included in standard disclosure, roll-forward and reconciliation reports. This may be the most essential reason why lease accounting software systems fail.

Disclosure Reports

Most lease accounting solutions have a standard one-page disclosure report containing numbers required by ASC 842, but they lack lease-level supporting details that auditors need to ensure the total amounts listed are accurate.

Missing details require accountants to pull amortization schedules from each lease record so auditors can tally the numbers to ensure they equal the total amounts on the disclosure report. If the reported amounts differ from the auditor’s totals, accountants must then spend additional time discovering where the errors are. When these discrepancies can’t be resolved, issues are documented as errors in the audit.

In mature lease accounting software, all amortization schedules are in the application, and supporting details for every lease are automatically published to the disclosure reports.

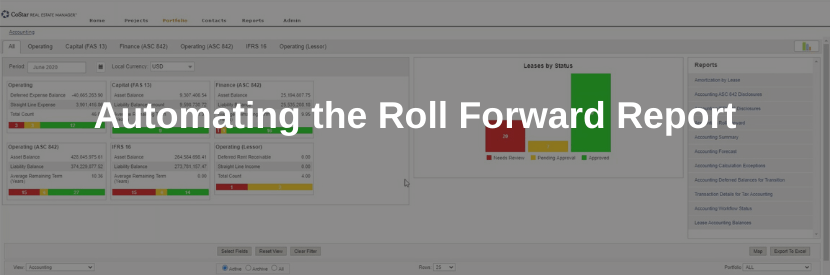

Roll Forward Reports

Auditors commonly request lease accounting roll forward reports, which present three main things:

- The company’s total balance of the ROU asset account and the total balance of the lease liability account at the beginning and end of a period.

- Numerical details that correspond with the following categories showing why the balances changed during that time: amortization, depreciation, additions, terminations, renewals and impairments.

- The balances and categories in total for the company and for each individual lease.

Without an automated roll forward report, accountants must pull separate reports from the ERP and their lease accounting software, perform VLOOKUPS in spreadsheets, and tie the reports together. Accountants must search through hundreds of lease records to identify balance changes associated with additions, terminations, renewals and impairments. They then must assume that balance changes not identified in their search were due to amortization and depreciation. This entire process can take days to complete and is fraught with risk, because auditors will test the assumptions.

Well-developed lease accounting software automatically runs a roll forward report with all supporting details formatted for audit presentations.

2. No Ad Hoc Reporting Flexibility

Another important reason why lease accounting software systems fail is the lack of ad hoc reporting, so users can’t create reports as needed on all lease data fields. For example, there’s no way to run a streamlined report that contains only amortization schedules for leases in a specific region that have been either impaired or terminated. To get the data that’s needed, accountants must run a standard report, export it to a spreadsheet, and then manually remove all other irrelevant records and fields.

Sophisticated software allows accountants to report solely on chosen fields and to filter by the company’s hierarchy. Users can drag-and-drop any lease data field into a report. Once an ad hoc report is created, it can be saved as a template, shared with others, updated on a set schedule, and emailed automatically.

3. No Accounting Policy Compliance Checks or Validation of Lease Data

Systems that can’t test lease data entries and bulk uploads for errors cause big reporting problems down the road. In addition to capturing and maintaining a high volume of lease data and associated amortization schedules, companies must maintain this information and ensure its accuracy for payment processing to landlords and vendors.

There are two main ways users enter incorrect data that software systems should test.

The first way is by manually entering data into a lease record. For example, ASC 842 says leases with a transfer of ownership clause should be classified as a finance lease, but accountants sometimes inadvertently tag them as operating leases. Other errors are made by incorrectly typing in data such as numbers or text details.

Ideal software automatically recognizes errors based on ASC 842 rules and provides instant error messages to users entering data. It also enables managers to run periodic exception reports, which can identify issues across a portfolio of leases. Such reports provide a list of previous warnings, actions that were subsequently taken, and usernames of those who took the actions, as well.

The second way incorrect data is input into the system is via bulk uploads, which allows the addition of numerous data points in seconds. Software that can’t identify missing or incorrect data creates extra work and errors downstream.

During bulk uploads, powerful software blocks those records whose fields contain incorrect or missing data. Users are immediately notified which records were blocked and which fields must be corrected before attempting to upload them again.

4. No Automatic Remeasurements

Without automatic remeasurement, users must create manual calculations for renewals, terminations, partial terminations and impairments.

Remeasurements occur often, yet many lease accounting software solutions have no ability to remeasure the amortization schedules. When performed within a spreadsheet, each type of remeasurement requires its own calculations, takes at least 30 minutes, and must be saved for auditors.

High-functioning lease accounting software automates remeasurements. Accountants can simply click on the type of remeasurement that is needed, and with just a few more clicks, the software automatically remeasures the ROU asset and lease liability, which is audit tracked as well.

5. No Automatic Retrospective True-Ups

Errors or omissions discovered after month-end close require manual corrections in spreadsheets when software lacks functionality to automatically fix these issues. Instead, accountants must show the amount that should have originally been booked, the amount that was booked, and the difference between the two. This tedious process is time consuming and introduces risk with accounting records maintained outside of the software.

Mature lease accounting software automatically calculates the true-ups based on the dates of adjustments, posts the impact to the general ledger in the current period with no impact to a closed accounting period, and maintains an audit trail of the transactions.

6. No Flexibility to Split Amortization Schedules

Systems lack the ability to break out lease details such as TIA amortization for tax, purchase accounting adjustments and cease use adjustments.

Without the ability to easily split amortization schedules, accountants are forced to create supplemental schedules in more spreadsheets. Each instance requires hours of additional work and introduces additional risk due to schedules housed outside of the software.

7. No Discount Rate Matching

Without automatic matching to company rate tables, accountants must research rates and insert them manually. Large companies have hundreds of rates to choose from as they’re based on geography, currency, lease term and type of lease.

Fully developed software allows organizations to upload their discount rate tables and automatically assign the correct rate to each lease based on the company policy, saving hours with a controlled process.

8. No Automatic Journal Entry Integrations with Approvals

Either systems can’t integrate with ERPs, aren’t supported, or some buyers discover that delivered integrations simply don’t work.

The lack of integrations with an ERP system forces accountants to download data from their leasing software and spend hours in spreadsheets manipulating columns into the prescribed format, removing unnecessary data, adding the right cost centers and GL strings, and then uploading the journal entries into the ERP.

Enterprise class software integrates with all major ERPs and financial systems, including those for accounts payable and accounts receivable, reconciliation and fleet vendors. These integrations create automatic workflows, save countless hours of manual workarounds and unnecessary processes and reduce the risk of errors. Integrations are also easily tracked and auditable.

9. No Ability to Add Company-Specific Fields

The inability to customize data fields for non-generic items creates another reason to separately track information in spreadsheets. Most companies have reasons to track information unique to either the business or industry, but most under-developed systems were created too hastily to accommodate information outside standard lease agreement fields. They only solve for a simple grossing up of the balance sheet.

The ideal system recognizes the need to maintain custom, company-specific data alongside standard lease data for ease of access and a single source of reliable information for relevant reporting.

If your existing lease accounting software is missing these essential, time-saving functions – or if you’re looking to implement the company’s first solution – get the system that can do all this and more CoStar.

CoStar is trusted and recommended by more leading accounting firms and service providers to manage and report on real estate and equipment for compliance with ASC 842 and IFRS 16 guidance. If your lease data is already in a database, upgrading is easier than you’d expect.

Share this

- Lease Accounting Software (89)

- ASC 842 (83)

- Accounting Teams (52)

- Lease Administration Software (26)

- Retail Tenants (16)

- Commercial Real Estate (14)

- Lease Management (12)

- Real Estate Teams (9)

- ESG (8)

- Market Data and Analytics (8)

- Success Stories (8)

- News and Media Coverage (5)

- Transaction Management Software (2)

- frs 102 (2)

- Customer Success (1)

- Office Tenants (1)

- July 2025 (1)

- June 2025 (4)

- May 2025 (2)

- April 2025 (2)

- March 2025 (6)

- February 2025 (3)

- January 2025 (4)

- December 2024 (1)

- October 2024 (4)

- September 2024 (2)

- August 2024 (5)

- July 2024 (3)

- June 2024 (3)

- May 2024 (4)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (3)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

3 Benefits of Automated Balance Sheet Reconciliation Reports

Planning for Lease Accounting Compliance: A 12 Step Guide for Successful Project Management