Lease Accounting Software: Be Audit Ready Anytime

As a lease accountant, you need a partner to help you close with confidence and deal with rapid change.

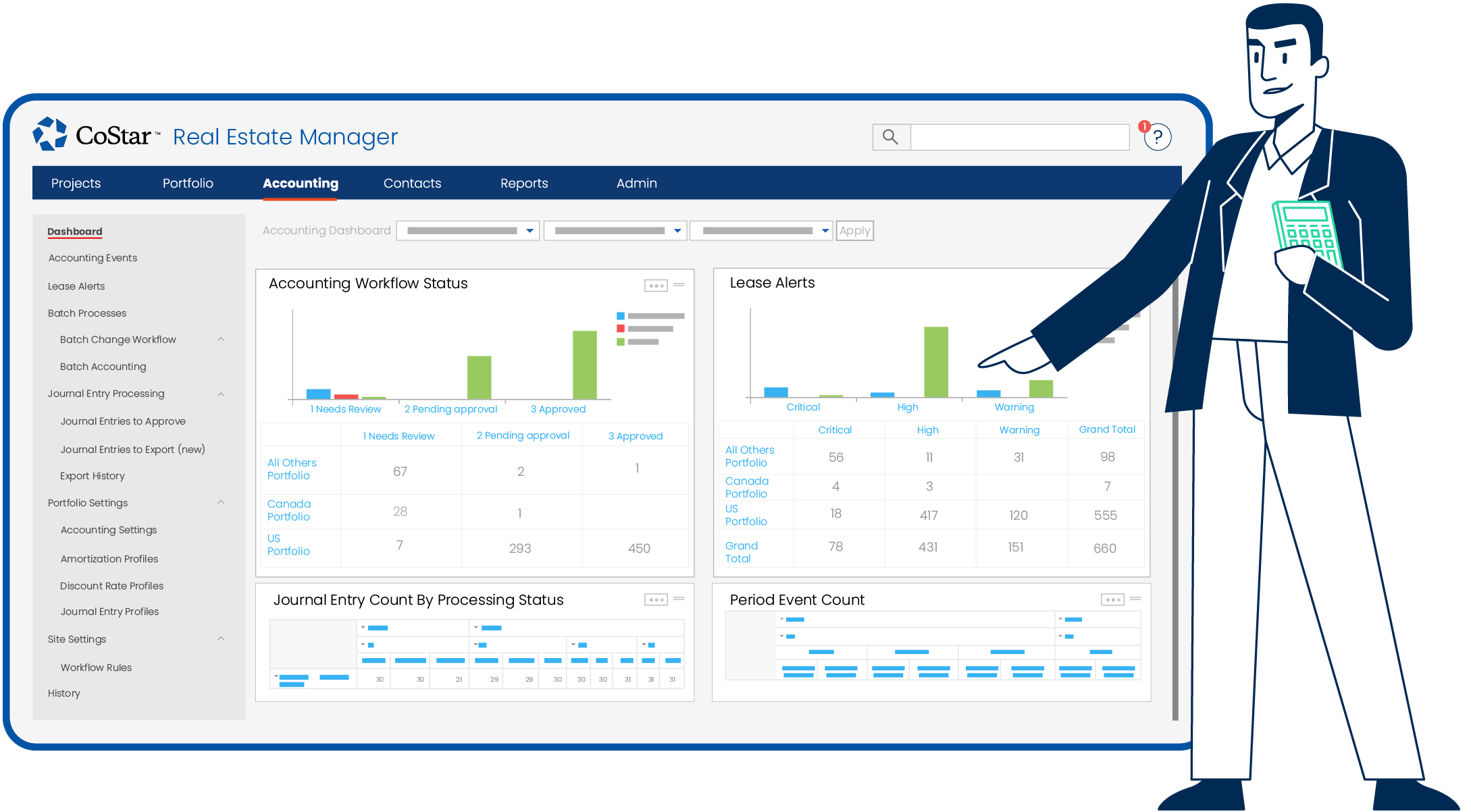

CoStar Real Estate Manager fits that bill.

You'll spend less time on ASC 842 and IFRS 16 compliance, be audit-ready anytime and enjoy flexibility to account for real estate and equipment leases. Want the best lease accounting software recommended by more advisory firms than any other lease accounting platform? Count on this one.

Why Lease Accountants Trust CoStar Real Estate Manager

Less Time on Compliance

With CoStar, you'll remeasure leases, perform retrospective adjustments and get even more done without extra spreadsheets. You'll see how automation greatly minimizes manual calculations, errors and restatements.

Respond to Audit Requests

Run standard reports in a click or drag-and-drop ad-hoc queries — with audit details always included. Enterprise-class security and workflows ensure accountability and accuracy. Be ready to be always-ready.

Accounting Your Way

Want your teams more in sync? With CoStar, you'll map journal entries to different accounts or maintain multiple lease amortization schedules per lease. You'll also get unlimited users plus user-defined dashboards.

Lease accounting can be incredibly complex, particularly with respect to ASC 842 compliance...CoStar is very customizable and packed with a lot of both critical and helpful functions. I appreciate the option to use as many or as little of these features as the business needs.

Verified G2 Reviewer

Warehousing Industry

We migrated to Costar in 2017, and it has been a great experience. The 842 Accounting and the 842 Reporting works very well. We originally were tracking overage accrual in a multi-sheet manually. Now we track our overages and perform the monthly accrual within Costar.

Nancy E.

Enterprise Organization

I like how easy it is to use and how quickly we are able to create a journal entry. It helps us keep a great look on our leases, as well as automate our monthly journal entries.

Kelsey S.

Senior Accountant

Accounting Workflow and Automation

The best lease accounting software has the most advanced automation to flow lease data from real estate, accounting and ops teams.

Lease Data Change Alerts

Lease accounting processes couldn't be more secure. Continuous rule-based monitoring of data changes instantly notifies managers to review and correct potential issues.

Guaranteed Managed Integrations

CoStar builds and monitors bulletproof connections to ERPs and other business systems to pay rent, post journal entries and produce audit-ready financial reporting.

Lease Accounting Software Tech Specs

Accounting Standards

ASC 842

IFRS 16

ASC 840

Local GAAP

Statutory GAAP

Audit & Security

Accounting schedules

Audit detail & change logs

Group & user profiles

Lease modifications

SSAE 18 SOC 1&2 Type 1&2

Controls

Data validation

Lease accounting journal entries

Lease classification tests

Security profiles

Single sign on (SSO)

Data Loading

Bulk lease data

Discount rates

Foreign currency

3rd Party integrations

Required fields

Lease Management

Equipment leases

Real estate leases

Multi-schedules per lease

No duplicate lease entries

Residual value

Lease remeasurement

Month End

High-volume capacity

JE approval & export

Payment processing

Period close out

Reconciliations

Vendor, AP, GL integration

Policy Setting

Fiscal calendars

APR/APY

Compound frequency

Lease/non-lease components

Amortization & JE profiles

Lease discount rate

Functional currency

Reporting

Ad hoc on all data fields

Amortization by lease

Disclosure report

Roll forward report

Tax data