Share this

by Justin Rubner on November 9, 2023

When workers at Atlanta-based general contractor DPR Construction returned to office after the pandemic, they were met with a boozy surprise:

A fancy wine bar.

As employers seek creative ways to lure workers back, some employees have been lucky to find more modern environments:

- Environmentally-friendly buildings.

- Quiet rooms to keep chatterboxes out.

- Collaboration spaces for said chatterboxes to shine.

- Amenities ranging from food halls to recording studios.

Employers have also been creative with converting unused spaces — such as closets — into coveted offices.

Real estate teams are grappling with two converging, unsolved trends:

High vacancy rates. Nationwide, the office vacancy rate is 13.4%, according to CoStar data. That’s up from 12.3% a year ago — and a record. Some cities have seen extraordinarily high rates: In Boston, for example, about 20% of all commercial space in Q3 was unused.

Unmet employee expectations. According to a survey by architecture firm Gensler, only 31% of U.S. offices have recently renovated their spaces — at a time when employers are trying to lure workers back in.

Office conversion opportunities

When the U.S. Securities and Exchange Commission left one Northern Virginia building recently, one might think another government entity would find the space attractive. Instead, it was transformed into a spa … complete with a Himalayan salt room.

Other recent non-intuitive examples include a “vertical” produce farm, a doggy daycare center and an elementary school. Brewery conversions? That's so 2019.

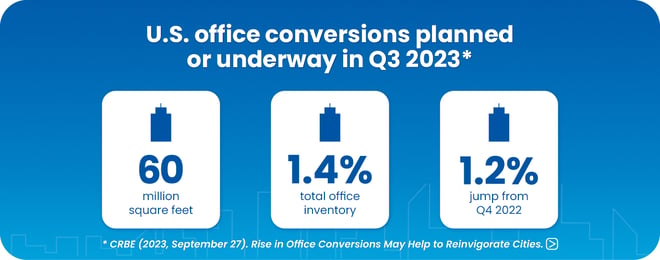

In Q3 2023, there were 60 million sq. ft. of U.S. office conversions planned or underway — 1.4% of the total office inventory and a 1.2% jump from Q4 2022, according to CBRE research.

Office-to-multifamily garners the lion’s share of conversions at 48%. No. 2 is life sciences, at 19%.

Geographically, Cleveland is tops: 11% of the city's office inventory is under conversion, according to CBRE.

Boston (3%) is one city getting aggressive. Officials are trying to solve the underutilization problem by attacking another problem: The lack of housing. A new program there doles out a whopping 75% property tax break to owners who convert buildings into residential use.

We need more affordable housing. It’s a problem many cities are trying to figure out. A vacated office building does no one any good.

Andy Peters

CoStar Staff Writer

Andy Peters, a commercial real estate reporter at CoStar, says he’s seeing more residential conversions occurring in cities that offer such incentives.

“We need more affordable housing,” Peters says. “It’s a problem many cities are trying to figure out. A vacated office building does no one any good.”

Meeting employee needs

We all know the pandemic was a watershed moment for how we work.

But Brooke Gothard, managing director at commercial real estate company JLL, says another big moment was in the 2010s.

“When I started, everything was more buttoned up,” Gothard says. “As technology firms flourished, everyone wanted to be that cool tech type of company. Dress codes relaxed. And office spaces became more collaborative.”

Growing up, we had group tables in school, whereas my parents’ desks were facing instructors. My generation grew up in a collaborative environment.

Brooke Gothard

JLL Managing Director

A big part of tech industry-influenced office design is due to younger generations coming in the workforce.

“Growing up, we had group tables in school, whereas my parents’ desks were facing instructors,” she says. “My generation grew up in a collaborative environment.”

With the pandemic over, real estate teams are facing two trends:

- The demand for hybrid environments

- The demand for nearby, walkable retail

Hybrid. It's “here to stay”, Gothard says, so employers should try to make environments work for this.

Retail. Having offices in easy walking distance can mean the difference between a quick sale and an asset going back to the lender. She says retail is "the theme" for 2023 and 2024.

The eBook every lease administrator should read

How to turn negotiations in your favor

“One of the most important things is location,” Gothard says. “That’s what’s killing some buildings. With good locations, tenants are fighting for space, whereas, 3 minutes down the road, it’s a drastic change.”

These trends are affecting lease negotiations. With fewer people in the office, some tenants are opting to extend leases but take on less space. Tenants who are OK with outdated buildings are getting better deals, while those looking for the best of both worlds are not.

"If you’re leasing a standard office building, the negotiations tip in favor of the tenant," Gothard says. "There's a lot of good deals right now. But if you want to be in a super hot building walkable to retail, that’s a different story."

Another looming factor could be the environment.

With ESG requirements increasing, employees may also be drawn to buildings with lower carbon footprints. Buildings with LEED certifications, air filtration, renewable energy sources and the like could increasingly be a draw.

How are employers reacting?

As employees come back to the office, most employers haven’t greeted them with modern interior design and kombucha machines. The lack of collaborative and alone spaces in particular have made RTO a bitter pill for some to swallow.

“Our expectations for how people work has shifted but the space has not,” Janet Pogue McLaurin, Gensler global director of workplace research, told CoStar News in June. “You want to come into the office to get your work done, which involves not only working with others but which also means working alone.”

Location + modern design + flexibility

Peters says he’s seen outdated buildings struggle to get leased. Employers with outdated buildings, he adds, have also grappled with getting workers back in the office.

“If you want people to come into a 90s-era office, you might struggle,” Peters says.

And employers with modernized offices — but located in unwalkable areas with no nearby retail — have also found it difficult to get workers to RTO.

A note of caution: Even with all boxes checked, it may still be hard for some companies to get employees back in.

Portland, Ore.-based software company Expensify, for example, in November said it was closing its cocktail lounge in its San Francisco office. Complete with branded ice cubes, and drink deliveries to workers' desks, the "experiment" failed to bring em in, the company's CEO said.

Winning the talent war

Still, companies like Microsoft have spent the bucks on campuses with good walkability and aesthetics as well as environments that support collaboration and privacy.

Peters recently toured Microsoft’s campus in Atlantic Station, Atlanta. From the outside, it was made to look mid-century. Inside, areas had distinct designs and amenities most wouldn’t think of, including a recording studio. He says the campus was “teaming with employees.”

Even in an employer’s market, employers that offer the trifecta — work environments that are better than they get at home with areas for collaboration and privacy, mixed with the flexibility of a hybrid model — can often win the talent war.

Share this

- Lease Accounting Software (90)

- ASC 842 (83)

- Accounting Teams (53)

- Lease Administration Software (27)

- Retail Tenants (16)

- Commercial Real Estate (14)

- Lease Management (13)

- Real Estate Teams (10)

- ESG (8)

- Market Data and Analytics (8)

- Success Stories (8)

- News and Media Coverage (5)

- Transaction Management Software (2)

- frs 102 (2)

- Customer Success (1)

- Office Tenants (1)

- December 2025 (1)

- September 2025 (1)

- July 2025 (2)

- June 2025 (4)

- May 2025 (2)

- April 2025 (2)

- March 2025 (6)

- February 2025 (3)

- January 2025 (4)

- December 2024 (1)

- October 2024 (4)

- September 2024 (2)

- August 2024 (4)

- July 2024 (3)

- June 2024 (3)

- May 2024 (4)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (3)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

5 Ways ESG Could Impact Corporate Real Estate for the Better

Six Commercial Real Estate Trends to Make You Feel Optimistic