Share this

by Matt Waters, CPA on April 8, 2022

As companies navigate lease management, they often need to update their discount rates. This helps them with accounting calculations for new and for existing leased assets that have changed. This can be a time-consuming task for companies that have many leases. But with the best lease accounting software, you can complete the process quickly and efficiently.

ASC 842 requires lessees to use the rate in the lease agreement for Net Present Value (NPV) calculations. You need this to set up lease liabilities and Right of Use (ROU) assets for most assets in your lease portfolio. However, the FASB recognized that implicit rate information is not always readily available. ASC 842 lets companies use an Incremental Borrowing Rate (IBR) if the lease agreement does not provide rate details.

To fully calculate the implicit rate in a lease, the lessee has to know about many variables. The lessor typically controls most of these extremely closely. Some even impact negotiations and therefore the lessor is seldom likely to release all lease data. Therefore, lessees most often use the IBR in concert with ASC 842 software to ensure compliance.

Automation🤝 Incremental Borrowing Rate

Read now: Automating the IBR for Lease Accounting

Defining IBR

ASC 842 defines the IBR specifically as, “The rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.”

Why Private Companies go with IBR

The ASC 842 lease accounting standard also allows private companies to use a risk-free rate. However, many private companies are opting to calculate an IBR as opposed to using the risk-free rate. This is because of the required present value calculations.

Balance sheet feeling wobbly?

How Private Companies Can Account for all ASC 842 Lease Types

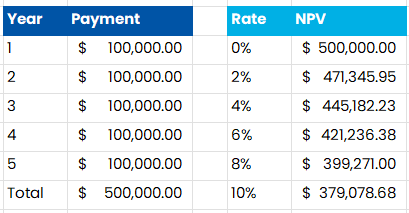

The charts below show a stream of 5 annual payments that equal $500,000. Using the NPV calculation in Excel with different discount rates shows that a lower discount rate leads to a higher NPV.

Many companies use the higher Incremental Borrowing Rate (IBR) instead of the risk-free rate. This occurs because companies use the Net Present Value (NPV) to determine lease liability under ASC 842. Therefore, reducing the impact to the balance sheet and financial statements.

Methods for securing IBR

Many appropriate methods exist for capturing and maintaining the IBR. Some companies have contracted with firms that specialize in valuations. Some work with their bankers regularly to obtain the information. And some work with their internal Treasury department and the list continues.

The IBR is an important factor in complex calculations. Therefore, companies should create an IBR policy. Then, they should discuss it with their auditors and clearly implement it throughout the audit trail.

Below is one practical method many companies use:

- Discuss the definition of IBR with your internal Treasury team. Ask for the current rates for each of the buckets you identify.

- US lease terms of 5, 10, 15, and 20 years are similar for international real estate. Some companies interpret this differently. They often set rates based only on the HQ location because borrowing happens mainly at the HQ.

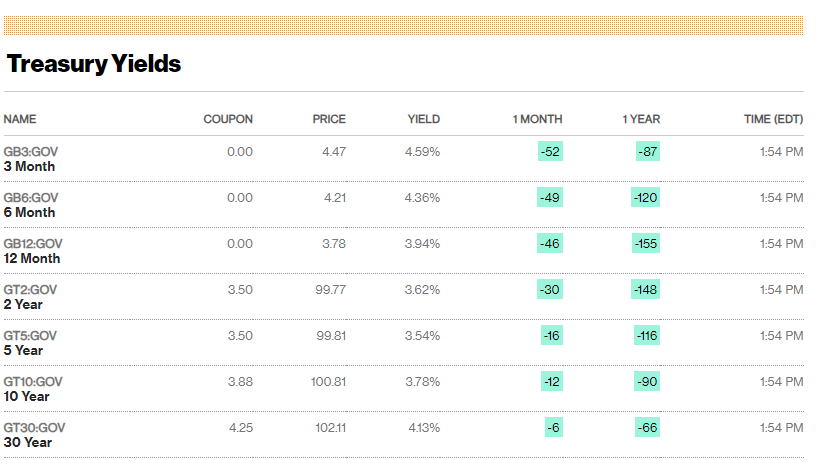

- Compare the rates that Treasury identifies with current readily available risk-free rates. The example presented in the chart shows the US Treasury Yields from the Bloomberg website.

- Compare the difference in the current risk-free rate and your company’s current IBR by bucket. The industry term for the difference is the “spread.”

- For example, your company's Treasury department states that the current rate for 5 years is 3.59%. However, Bloomberg reports a rate of 1.59%. The difference between these rates is 2%.

Now you have a simple mechanism to update the 5-year rate any time lease accounting requires the rate. Going to Treasury each time for an update is inefficient.

However, it is quick and easy to pull the latest risk-free rate from Bloomberg. You simply add the pre-established spread and move on. For example, assume one month has gone by and the Bloomberg site says the new risk-free rate is 1.75%. Add the 2% spread, and your new IBR is 3.75%.

This method is reasonable because it captures the macroeconomic factors regarding interest rates (fluctuations in the publicly available risk-free rate). It also captures more microeconomic factors (e.g. company credit rating) in the spread. It is important to review the method with your Treasury team and update the spread periodically.

This is one practical method for capturing and maintaining effectively used IBR data. There are, however, others that may be appropriate. The best practice is to identify a reasonable method, document internally and review with auditors.

Share this

- Lease Accounting Software (90)

- ASC 842 (83)

- Accounting Teams (53)

- Lease Administration Software (27)

- Retail Tenants (16)

- Commercial Real Estate (14)

- Lease Management (13)

- Real Estate Teams (10)

- ESG (8)

- Market Data and Analytics (8)

- Success Stories (8)

- News and Media Coverage (5)

- Transaction Management Software (2)

- frs 102 (2)

- Customer Success (1)

- Healthcare real estate (1)

- Office Tenants (1)

- December 2025 (1)

- September 2025 (1)

- July 2025 (2)

- June 2025 (4)

- May 2025 (2)

- April 2025 (2)

- March 2025 (6)

- February 2025 (3)

- January 2025 (4)

- December 2024 (1)

- October 2024 (4)

- September 2024 (2)

- August 2024 (4)

- July 2024 (3)

- June 2024 (3)

- May 2024 (4)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (3)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

What is an ASC 842 Lease Accounting Discount Rate?

What the ASC 842 Discount Rate Update Means for Non-Public Companies