Share this

by Dave Koerschner on November 10, 2022

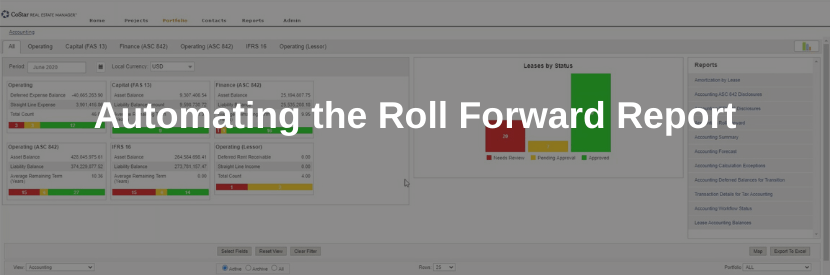

Real estate and accounting teams need shared access to leasing data and the ability to create a variety of lease management reports to do their jobs. Many companies need the ability to cross-functionally report on financial information within the organization. These financial reports may cover topics such as future obligation forecasting, asset and liability roll-forward balances, monthly reviews of standing asset and liability amounts, and even quarterly and annual disclosures.

While it’s important to capture this financial reporting information across an entire portfolio, often users need to narrow down this data to focus on a particular area of the business. This may take the shape of separate business units, company codes, cost centers, operating entities, legal entities, countries, continents, or other geographical regions, all depending upon the way a business is organized. For lease accounting, users need to be able to quickly and effortlessly “slice and dice” reports to pull this information across a company’s organizational structure, however it may be organized, to provide timely and accurate information to technical accounting teams, upper management, and internal and external auditors. Lease accounting software should provide security features so that only authorized persons will be able to view, change or report on data under their jurisdiction. Those users should have the ability to run a variety of reports that show only the selected data a user wants. Standard reports—such as accounting forecast, disclosure and roll forward reports—and ad hoc reports should be available for any combination of portfolios and easily roll up to consolidated reporting. Ad hoc reports should allow authorized users to use filters to determine which data they would like included so they are not inundated with extraneous information. When leasing software lacks the ability to filter data for reports, accountants are forced to run a report that includes data for the entire company. Then they have to export that report into a spreadsheet, use Excel’s Vlookup function to add in labels that identify the data according to the company’s hierarchy, and then use filters, subtotals, or pivot tables to reorganize the data to display only their portfolio of leases.

Share this

- Lease Accounting Software (90)

- ASC 842 (83)

- Accounting Teams (51)

- Lease Administration Software (27)

- Retail Tenants (16)

- Commercial Real Estate (14)

- Lease Management (12)

- Real Estate Teams (9)

- ESG (8)

- Market Data and Analytics (8)

- Success Stories (8)

- News and Media Coverage (5)

- Transaction Management Software (2)

- frs 102 (2)

- Customer Success (1)

- Office Tenants (1)

- July 2025 (2)

- June 2025 (4)

- May 2025 (2)

- April 2025 (2)

- March 2025 (6)

- February 2025 (3)

- January 2025 (4)

- December 2024 (1)

- October 2024 (4)

- September 2024 (2)

- August 2024 (4)

- July 2024 (3)

- June 2024 (3)

- May 2024 (4)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (3)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

Why Lease Accounting Software Systems Fail

Assured Partners: A CoStar Case Study