Share this

by Matt Waters, CPA on September 12, 2023

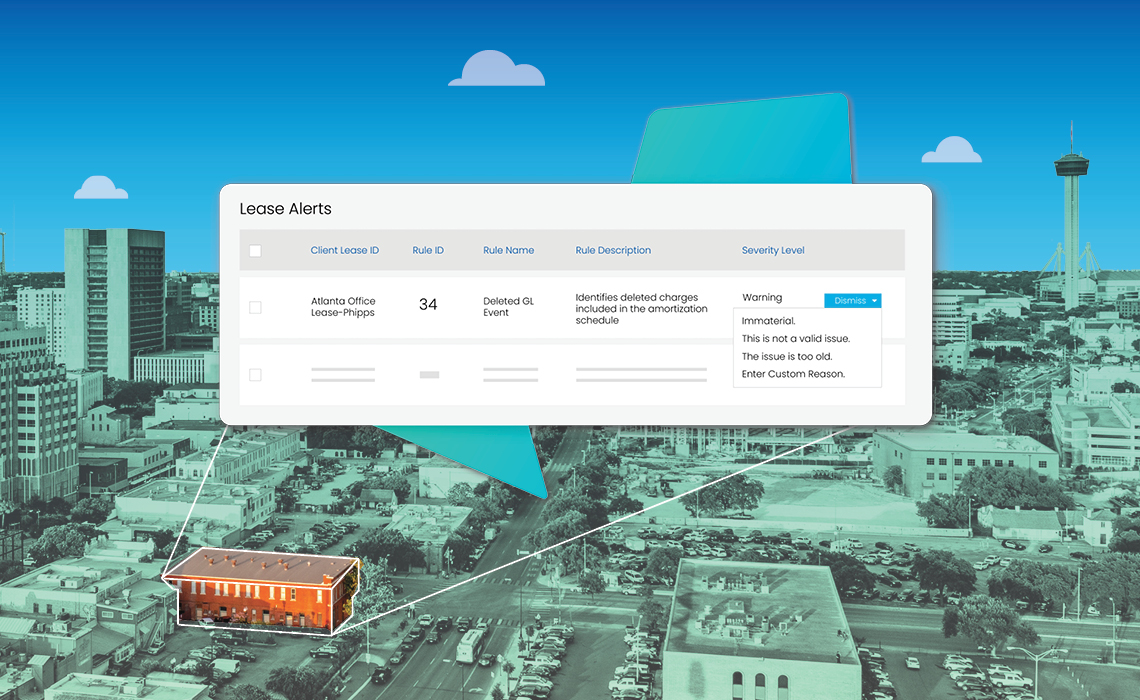

Most lease accounting solutions have standard ASC 842 reporting functionality, like the one-page disclosure report. But the outputs don’t always include lease-level supporting details.

Without this information, accountants must manually pull amortization schedules from all ASC 842 leases. That way, auditors can tally the numbers to ensure they equal the total amounts on the disclosure report.

If the reported amounts differ from the auditor’s totals, accountants must then spend additional time discovering where the errors are. If we don't resolve these discrepancies, we document them as errors.

To produce manual roll forward reports, accountants have a lot to do. They must:

- Pull separate reports from the ERP and their lease accounting software.

- Manually perform VLOOKUPS in spreadsheets.

- Tie the reports together.

This process could require searching hundreds of lease records, take days to complete, and is fraught with risk. Because auditors will test the assumptions.

There's one solution to all these reporting challenges. Accounting teams must ensure that they hold all amortization schedules in a lease accounting software system. And that the schedules have supporting audit details.

It must be a lease accounting software that can automatically produce disclosure and roll forward reports. As well as any other ad hoc reporting requests that ASC 842 requires. All with supporting details always included and formatted for audit presentations.

This is one of the five important steps for being audit-ready. Read more in the new eBook Five Ways Lease Accountants Can Be Audit-Ready Anytime.

Share this

- Lease Accounting Software (90)

- ASC 842 (83)

- Accounting Teams (53)

- Lease Administration Software (27)

- Retail Tenants (16)

- Commercial Real Estate (14)

- Lease Management (13)

- Real Estate Teams (10)

- ESG (8)

- Market Data and Analytics (8)

- Success Stories (8)

- News and Media Coverage (5)

- Transaction Management Software (2)

- frs 102 (2)

- Customer Success (1)

- Office Tenants (1)

- December 2025 (1)

- September 2025 (1)

- July 2025 (2)

- June 2025 (4)

- May 2025 (2)

- April 2025 (2)

- March 2025 (6)

- February 2025 (3)

- January 2025 (4)

- December 2024 (1)

- October 2024 (4)

- September 2024 (2)

- August 2024 (4)

- July 2024 (3)

- June 2024 (3)

- May 2024 (4)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (3)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

Why Your ASC 842 Solution Should Continuously Validate Lease Data

It's time to Automate Lease Remeasurements