Share this

by Matt Waters, CPA on March 27, 2017

Many companies have a list of questions for FASB regarding its new ASC 842 lease accounting standard.

The Financial Accounting Standards Board (FASB) and advisers report a significant uptick in questions regarding the new ASC 842 lease accounting standard as companies delve into details regarding leases that need to be added to their balance sheets. Among the most popular questions include “what exactly is a lease?”

According to Compliance Week, the companies generating the most questions regarding new lease accounting guidelines are the largest companies that will be most affected by the change. In particular, companies whose real estate leases are vital to company operations, such as big retailers and global decentralized organizations.

The increased volume of questions makes sense, as a recent survey reported more than one third of respondents are only “somewhat prepared” to comply with the new lease accounting standards. More than 25 percent are “Not too prepared” and almost 10 percent are “Not prepared at all.”

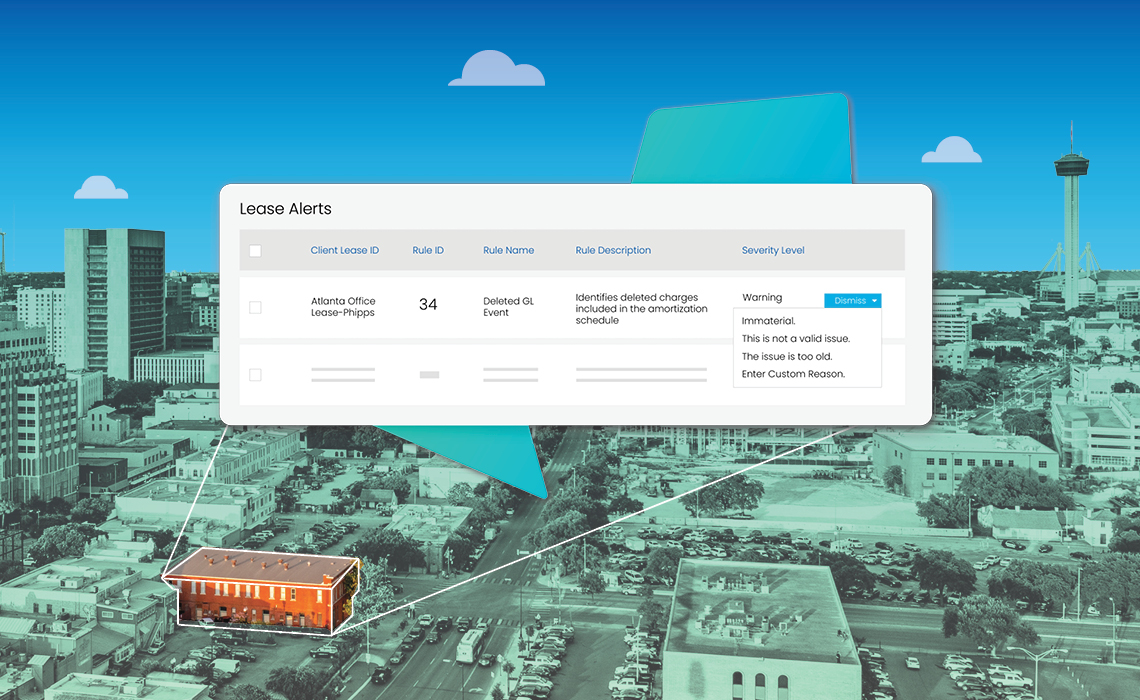

As companies of all sizes sift through lease agreements of all types and put processes and controls in place to ensure compliance, it is anticipated that the demand for a streamlined, centralized IT solution will also increase. To avoid errors resulting from disjointed data housed in separate software programs, it is recommended that companies get a global view of all lease data by consolidating lease obligations – including real estate, equipment, fleet and other leases – into one centralized system. Benefits include uniform processes for data entry and record-keeping, which leads to overall higher quality of data, reliability and successful compliance.

Share this

- Lease Accounting Software (90)

- ASC 842 (83)

- Accounting Teams (53)

- Lease Administration Software (27)

- Retail Tenants (16)

- Commercial Real Estate (14)

- Lease Management (13)

- Real Estate Teams (10)

- ESG (8)

- Market Data and Analytics (8)

- Success Stories (8)

- News and Media Coverage (5)

- Transaction Management Software (2)

- frs 102 (2)

- Customer Success (1)

- Office Tenants (1)

- December 2025 (1)

- September 2025 (1)

- July 2025 (2)

- June 2025 (4)

- May 2025 (2)

- April 2025 (2)

- March 2025 (6)

- February 2025 (3)

- January 2025 (4)

- December 2024 (1)

- October 2024 (4)

- September 2024 (2)

- August 2024 (4)

- July 2024 (3)

- June 2024 (3)

- May 2024 (4)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (3)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

3 Ways Lease Accounting Compliance Plans Can Fail

What Is a Lease Under ASC 842?