Share this

Incremental Borrowing Rate: How to approach IBR under ASC 842

by Matt Waters, CPA on April 8, 2022

ASC 842 requires lessees to use the rate implicit in the lease agreement for the Net present value (NPV) calculations furthermore required to set up lease liabilities and ROU assets for virtually every lease. However, the FASB recognized that implicit rate information is not always readily available. ASC 842 allows the use of an Incremental Borrowing Rate (IBR) when the rate information is not included in the lease agreement.

To fully calculate the implicit rate in a lease, the lessee has to know about many variables. Most of which are typically controlled very closely by the lessor. Some even impact negotiations and therefore the lessor is seldom likely to release all information. Therefore, the IBR is used most often in practice as lessees comply with lease accounting guidelines.

Defining IBR

ASC 842 defines the IBR specifically as, “The rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.”

Why Private Companies go with IBR

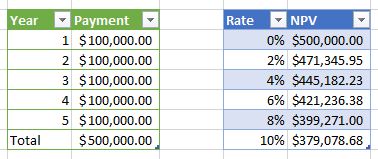

ASC 842 also allows private companies to use a risk free rate. However, many private companies are opting to calculate an IBR as opposed to using the risk free rate. This is because of the required present value calculations. The charts below show a stream of 5 annual payments that add up to $500,000. Applying the NPV calculation in Excel using various discount rates proves that the lower the discount rate, the higher the NPV. Because NPV is the basis for the Lease Liability under ASC 842, many companies are correspondingly opting to use the higher IBR vs the risk free rate. Thus reducing the impact to the balance sheet.

Methods for securing IBR

There are many appropriate methods for capturing and maintaining the IBR. Some companies have contracted with firms that specialize in valuations, some work with their bankers on a regular basis to obtain the information, some work with their internal Treasury department, and the list goes on. Because the IBR is a key variable with a major impact on lease accounting calculations, it is important for companies to set an IBR policy and review with auditors. Below is one a practical method many companies use:

Five steps to calculate and maintain the IBR (an example)

- Discuss the definition of IBR with your internal Treasury team. Ask for the current rates for each of the buckets you identify.

- US 5, 10, 15, 20 year leases and similar for international locations, note that some company’s interpretations lead to only setting up rates based on the HQ location, because that is where all borrowing occurs.

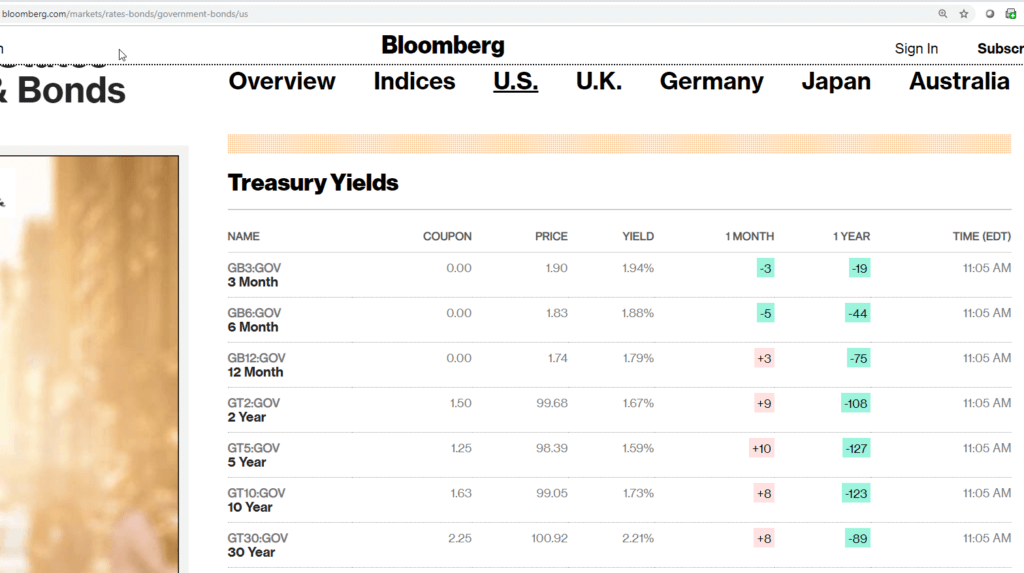

- Compare the rates that Treasury identifies with current readily available risk free rates. The example presented in the chart shows the US Treasury Yields from the Bloomberg website.

- Compare the difference in the current risk free rate and your company’s current IBR by bucket. The industry term for the difference is the “spread”. For example, if your company’s Treasury department confirms that the current rate for 5 years is 3.59% and the rate pulled from Bloomberg is 1.59%, the spread is 2%.

- Now you have a simple mechanism to update the 5 year rate any time lease accounting requires the rate. It would be inefficient to go to Treasury each time for an update. However, it is quick and easy to pull the latest risk free rate from Bloomberg. You simply add the pre-established spread and move on. For example, assume one month has gone by and the Bloomberg site says the new risk free rate is 1.75%. Add the 2% spread, and your new IBR is 3.75%.

- This method is reasonable because it captures the macroeconomic factors regarding interest rates (fluctuations in the publicly available risk free rate). It also captures more microeconomic factors (e.g. company credit rating) in the spread. It is important to review the method with your Treasury team and update the spread periodically.

This is one practical method for capturing and maintaining effectively used IBR data. There are, however, others that may be appropriate. The best practice is to identify a reasonable method, document internally, and review with auditors.

Share this

- ASC 842 (78)

- Lease Accounting Software (59)

- Accounting Teams (36)

- Lease Administration Software (13)

- Retail Tenants (12)

- Commercial Real Estate (8)

- Lease Management (8)

- Market Data and Analytics (7)

- Real Estate Teams (5)

- Success Stories (5)

- News and Media Coverage (2)

- Transaction Management Software (2)

- Customer Success (1)

- Office Tenants (1)

- April 2024 (1)

- February 2024 (1)

- December 2023 (4)

- November 2023 (6)

- October 2023 (4)

- September 2023 (2)

- August 2023 (2)

- July 2023 (3)

- May 2023 (2)

- March 2023 (1)

- February 2023 (3)

- December 2022 (3)

- November 2022 (4)

- October 2022 (4)

- September 2022 (1)

- August 2022 (4)

- June 2022 (1)

- May 2022 (4)

- April 2022 (8)

- March 2022 (3)

- February 2022 (1)

- October 2021 (2)

- September 2021 (1)

- August 2021 (15)

- July 2021 (3)

- June 2021 (1)

- May 2021 (1)

- April 2021 (3)

- March 2021 (1)

- January 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (2)

- September 2020 (2)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (1)

- April 2020 (1)

- March 2020 (1)

- February 2020 (1)

- December 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- April 2019 (69)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- May 2018 (1)

- April 2018 (2)

- March 2018 (3)

- February 2018 (2)

- December 2017 (1)

- August 2017 (3)

- June 2017 (2)

- May 2017 (2)

- April 2017 (1)

- March 2017 (2)

- January 2017 (2)

- November 2016 (2)

- July 2016 (1)

- June 2016 (1)

- July 2015 (1)

- March 2015 (1)

- June 2014 (1)

- April 2014 (11)

- October 2011 (1)

You May Also Like

These Related Stories

Questions Answered About Fair Market Value Leases

Lease Accounting Fallout from COVID-19